Next Results for articles with tag 'banking' (23 total)

While there have been a few promising innovators in the field of financial services, like Mint and some peer to peer lenders, nothing has really shaken the industry out of its lethargy and done something to meet the real needs of consumers.

BankSimple could be about to change that. Instead of trying to work outside the system and bring something new to the table, BankSimple is using existing financial players to provide the basic banking services, but is using its skills to provide a radically new customer service experience on top.

The company clearly believes and understands that consumers are looking for something new.

"BankSimple will be a worry-free alternative to traditional personal banking. No surprise fees and the customer service you deserve. And that's just the beginning."

The company seems to determined to provide consumers with a simple way to manage and understand their finances- with interesting tools to help people know how much money they have to spend, set saving goals, etc.

They also intend to explore new ideas, like couples sharing accounts and friends joining together for transactions.

Hopefully, BankSimple will also be able to use its rich dataset to encourage its FDIC approved partners to provide more innovative financial services products.

If they can succeed by combining excellent customer service through the innovative application of tools and user interface with new products, the banking establishment could well have something to worry about.

The company plans to launch in 2011.

One group of consumers who might find BankSimple highly attractive are "the first time defaulters" that Deloitte identified in a recent study.

This group, which represents 11% of the banking population are people who've been hit by a negative credit situation, in the last two years, for the first time in their lives.

This group has a very bad impression of banks.

- 41% of the 5,000-odd survey respondents rated their interaction with their lenders "poor"

- 43% doubted the banks' "willingness to listen to my concerns."

- Two-thirds said they are unlikely to borrow again from the same institution in the future.

If BankSimple can find these people, it would be a nice base to build from, but it's going to have to find not just deliver excellence through UI, but actively "listen" to these customers concerns and provide solutions.

Posted by Ed Cotton

The latest foreclosure crisis is a case in point. Something appears really rotten in the system and despite all efforts to provide a smokescreen, this latest episode can do nothing to shift consumer confidence in banking institutions upward.

Jonathan Weil writing for Bloomberg sums it up.

"The banks only have themselves to blame for the fix they're in. Three years ago, as the subprime mortgage crisis began to spiral, one of the lessons the public should have learned is that the leaders of these companies often have no idea of what's going on inside them. We may be witnessing the same phenomenon again. There's no excuse this time for anyone to be surprised.

When and if you happen to spend 30 minutes watching CNBC and you see the ads for the large institutions, the same arrogance abounds. Take a look at this UBS wanting to Apple ad. It's as if nothing has happened and the world is just the same as it was in 1984.

For anyone responsible for the image of a bank, these are tough times, but on the bright side, there's a massive opportunity for someone who can rise from the ashes of distrust and present an image and importantly, a product offering that's truly in-step with the times.

Posted by Ed Cotton

King suggests that the branch infrastructure could be one of the first things to disappear.

"Even if only 50 per cent of cash transactions are replaced by electronic stored value cards, debit cards and mobile wallets in the next five to ten years, the current ATM and Branch infrastructure that supports cash becomes almost untenable from a cost burden perspective. If you no longer need to go to the ATM to withdraw physical cash or currency, then everything you do on the ATM today can be done on your mobile App phone. If branches no longer need to deal with cash, then a large part of the reason for their existence disappears."

The branch has been the most visible form of brand communication for most banks through history and the point of physical connection and a demonstration of their strength and security. Take the branch a way and you have a whole new world.

Just as an example- take a look at these images of the old Williamsburg Savings Bank to see just how the branch was used to communicate the brand's power in an almost regal or Church-like manner. Ironically, the bank no longer exists and is now used as the site for a weekend flea market.

Posted by Ed Cotton

The brand had reached a point where its very power threatened it. While others suffered, Goldman prospered and its bankers became the target of everyone who hadn't been so fortunate. Goldman had multiple chances to show humility and to transform itself into something more transparent and balanced, but it took government action and public humiliation for the bank to take a long hard look at itself.

While business leaders and brand experts love powerful brands, their very power can threaten their core. It would be smart if every strong brand was big enough to realize that humility goes a long way these days and every bound forward needs to be balanced with a measure of humbleness.

UK grocery chain Tesco has been in superpower position for many years, as it's expanded geographically and into other business areas, it has been the subject of serious scrutiny. The brand has simply got too powerful and is at a point where it has to be careful with every action it takes. While it's shareholders and business leaders want the brand to become even more powerful, this power seems to have its limits.

As Tesco continues to expand into all four corners of the UK, it's meeting pockets of resistance from local governments who are making serious demands in return for the brand's continued expansion. These financially constrained local governments want some of Tesco cash reserves to fund housing, a move which is forcing Tesco into a business that it never intended to be in, homes.

While this news is fodder for any brand wizard wanting to show the amazing elasticity of power brands, it's something of a problem for Tesco, as it confirms their status of all conquering power.

However, perhaps there's a way that Tesco could turn this unintended consequence into a positive?

What if it was to create a foundation to facilitate the house building process and do it any way that pushed the boundaries on sustainability and provided homes at a low cost to those in need?

What if it could find a way to contribute something meaningful to society, like a new concept of community and do this through its foundation?

Tesco executives might be wise to read Fordlandia, the story of Henry Ford's attempt to create a perfect mid-western style company town in the middle of the Amazon.

While on paper, it looks like another example of corporate imperialism, dig deeper and you find Henry Ford wanted world class medical care and the best living standards for his workers, but more than that, he wanted community.

There's nothing wrong with powerful brands, but at some point, they all have to realize that humility and giving back are the only ways to stop them toppling over thanks to their own arrogance.

Posted by Ed Cotton

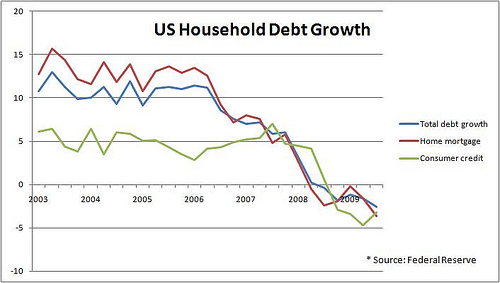

Looking at this data, it provides some insight as to why the President acted as he did.

However, there's more to this story than meets the eye and more questions to ask.

- What type of banks don't people trust?

- What is it about banks that they don't trust?

I am sure Edelman have this data and it would be great to see it if they do.

Banks clearly have a huge issue that is in crisis proportions and something they need to devote a lot of energy towards. Simply ignoring the issue and hoping it will go away, isn't going help. These institutions need a whole way of thinking about how they need to relate to and communicate with their customers and beyond this need ideas that prove they are to be trusted.

Posted by Ed Cotton

Posted by Ed Cotton

Next

Articles for tag banking (23 total).