The latest foreclosure crisis is a case in point. Something appears really rotten in the system and despite all efforts to provide a smokescreen, this latest episode can do nothing to shift consumer confidence in banking institutions upward.

Jonathan Weil writing for Bloomberg sums it up.

"The banks only have themselves to blame for the fix they're in. Three years ago, as the subprime mortgage crisis began to spiral, one of the lessons the public should have learned is that the leaders of these companies often have no idea of what's going on inside them. We may be witnessing the same phenomenon again. There's no excuse this time for anyone to be surprised.

When and if you happen to spend 30 minutes watching CNBC and you see the ads for the large institutions, the same arrogance abounds. Take a look at this UBS wanting to Apple ad. It's as if nothing has happened and the world is just the same as it was in 1984.

For anyone responsible for the image of a bank, these are tough times, but on the bright side, there's a massive opportunity for someone who can rise from the ashes of distrust and present an image and importantly, a product offering that's truly in-step with the times.

Posted by Ed Cotton

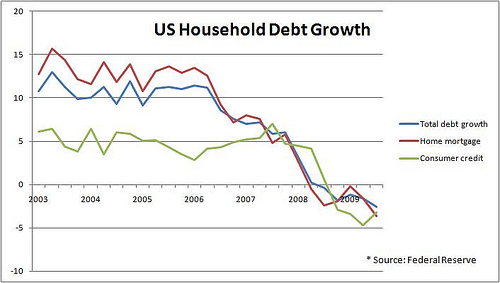

Looking at this data, it provides some insight as to why the President acted as he did.

However, there's more to this story than meets the eye and more questions to ask.

- What type of banks don't people trust?

- What is it about banks that they don't trust?

I am sure Edelman have this data and it would be great to see it if they do.

Banks clearly have a huge issue that is in crisis proportions and something they need to devote a lot of energy towards. Simply ignoring the issue and hoping it will go away, isn't going help. These institutions need a whole way of thinking about how they need to relate to and communicate with their customers and beyond this need ideas that prove they are to be trusted.

Posted by Ed Cotton

Posted by Ed Cotton

Here's a quote from a testimony he gave to congress yesterday.

"However, the financial and economic recovery still faces significant headwinds. Unemployment remains high, along with foreclosure and delinquency rates. Although RealtyTrac's October report shows a third straight month of decreasing foreclosure activity, foreclosures are still up nearly 19 percent since October 2008. And delinquencies of subprime residential mortgages reached over 26 percent and conforming mortgages nearly seven percent in the third quarter. Further, according to First American CoreLogic, roughly one in four homeowners owed more on their mortgages than the properties were worth in the third quarter of 2009. These conditions place enormous pressure on American families and homeowners.

Bank lending continues to contract overall, although the pace of contraction has moderated and some categories of lending are growing again. For example, commercial and industrial loans contracted at an annual rate of 27 percent in the third quarter, but 16 percent since then. Such loans are particularly important for small businesses, which generally cannot raise money by issuing debt in securities markets. Meanwhile, residential mortgage loans from banks have increased at an annual rate of two percent since the third quarter.

The contraction in many categories of bank lending reflects a combination of persistent weak demand for credit and tight lending standards at the banks, amidst mounting bank failures and commercial mortgage losses. There have been 130 bank failures this year, compared with 41 over the decade that preceded the current recession. And the number of banks that the FDIC classifies as "problem institutions" has reached over 550 this year, compared with 76 in 2007 and 252 in 2008. Further, FDIC-insured commercial banks reported that net charge-offs--that is, losses that have occurred--increased to 2.9 percent as a share of loans and leases in the third quarter, up from 0.6 percent before the recession. And delinquencies of commercial real estate loans were nine percent in the third quarter and increasing.

Banks' willingness to lend also has a significant impact on consumer spending and, consequently, economic growth. Macroeconomic Advisors, a consulting firm, found that a 10-point increase in bank's willingness to make consumer installment loans yields a 0.3 percentage point increase in personal consumption expenditures."

So, what's he saying...

- Foreclosures are still around and bigger than they were in 2008, but activity is decreasing.

- A quarter of all homeowners owe more on their property than their property is worth.

- Mortgage loans are growing, but banks are not lending to business.

- Banks are still in trouble- 130 bank failures this year and 550 classified as "problem institutions".

While many are talking about recovery, these factors which don't even examine unemployment, suggest this is going to take time.

Posted by Ed Cotton

A bank should only go begging to its customers for understanding if there was a well of support and a high degree of respect for the brand and the category. Anything short of a stellar reputation and it's going to end badly. Now is not the time for such a plea.

However, Westpac in Australia seem oblivious to current sentiment. The bank sent out an email film to its customers explaining in the most patronizing way how the financial system worked and why bank rates where heading higher.

Given what people have been through with banks and the endless press on bonuses and the stratospheric pay packages of banking's top level, it's impossible to understand how Westpac's customer base could be sympathetic to the plight of a bank who now faces higher costs for borrowing money.

One can just imagine how this film came to be, harried marketing executives believing that if only the ignorant public could understand the reasons why money now cost more, things could be better, taking this thought to their ad agency and getting them to make an "educational film". The problem here is that the voice is all wrong, there's no empathy, understanding or even a recognition of some intelligence on the part of their customers. The fact this made it though the system shows an institution with a very low EQ and one that fill find its little exercise in education ends up losing it a ton of valuable customers.

Banking still has a lot to learn from how to respond to the current crisis. It does not seem like any of them get it, most don't want to acknowledge the realities of a changed context and a changed relationship. Most of the recent marketing efforts fall short, they show a lack of an insight and an inherent desire to turn the clock back to the days of old.

Recent research data from Bloomberg shows that Americans are pretty angry with bankers.

"Two-thirds of Americans say they have an unfavorable view of financial executives. More than half say big financial companies, which are expected to pay record yearend bonuses, are out only to enrich themselves and also should not have received government aid. "

The incumbents failure to get it right, could leave the door open to a smart opportunist who gets exactly what the consumer is looking for now, doesn't show the same patronizing attitude of old and finds a way to provide superior services at a much lower cost.

Posted by Ed Cotton

Ally Bank is a new entity that's arisen out of the former GMAC. It should have been a chance to doing something very different, but it still looks like old banking.

Here's what they say on their website.

"We are Ally Bank, built on the foundation of GMAC Financial Services. And with that experience we’ve learned that these times demand change and a new way of doing business. So we’re taking banking in a new direction.

We’re a bank that values integrity as much as deposits. A bank that will always be open, accountable, and honest. Yes, honest. We won’t deal in half-truths, kindatruths, or truths only buried in fine print. That’s because we don’t have anything to hide. We’re always going to give it to you straight.

That means no monthly fees, no minimum deposits, and no minimum balances. It means developing new products that give you more options, like our No Penalty CD that lets you withdraw your money if you need to. And it means keeping our promise that our rates will always be among the top. It’s just the right thing to do."

Is this bank really doing anything different, it sounds good, but the promises and products seem fairly standard.

If the financial services industry is going to rebuild its reputation, it's going to need to invest in some serious product development. Without this, it's just going to be a series of hollow promises.

Posted by Ed Cotton